Related Post

ABOUT UPI LITE

UPI LITE is a new payment method introduced by NPCI (National Payments Corporation of India). It is an online wallet that permits small transactions. UPI LITE does not require UPI pins and is user-friendly. It can only transact up to ₹500 at a time and up to ₹4000 daily. UPI LITE is available within selective UPI apps introduced by NPCI like BHIM, GOOGLE PAY, AND PAYTM. Users can easily make small-value payments by using UPI QR codes, mobile numbers, UPI IDS, bank accounts, or transactions through VPAs. UPI LITE was launched by the RBI or Reserve Bank of India, on the BHIM app to help users make small-value transactions. And offers unlimited transactions. However, it cannot be enabled for multiple accounts at the same time. The BHIM UPI app currently offers the UPI LITE feature.

FEATURES OF UPI LITES

1. No transaction fees

Users do not have to pay any extra fees to make the transaction.

2. No UPI pins

UPI LITE does not require a PIN for small-value transactions.

3. NO KYC requirements

Earlier UPI apps required KYC verifications for using online payment apps. UPI LITE does not require any KYC verifications of the user and can be used by all.

4. Offline features

UPI LITE allows users to make payments offline without internet service availability. This feature draws the attention of all online payment users, as the payment can be made offline without an internet connection.

5. Record transaction

The transaction made by the user is recorded on the app itself. It does not record the transaction on the bank statements.

6. Refunds

This app also helps users retrieve their accounts in case they lose their phone. The users can easily request a refund from the bank.

HOW DOES THE UPI LITE WORK?

1. REGISTRATION

- Download UPI apps like BHIM, Google Pay, or Paytm from the Play Store or Apple Store.

- Link your active bank account to activate your UPI LITE feature.

- Anyone with an existing account on any UPI app can directly access it by adding funds.

2. ADDING FUNDS

You can easily add money from your active bank account to the UPI LITE wallet and start using your app. The user can only make small value transactions through this app, which is good for daily use.

3. MAKING PAYMENTS

The user can only make a payment of ₹500 per transaction. This app does not require UPI pins for any transaction. You can make payments through QR codes, directly to bank accounts, UPI IDs, or phone numbers. The transaction limit in this app is only up to ₹4000 per day.

HOW IS UPI LITE DIFFERENT FROM UPI?

1. TRANSACTION LIMITS

UPI offers a maximum of ₹ 2 lakh transactions from a bank account. And its user can make 20 transactions a day. Whereas UPI LITE offers unlimited transactions a day. But the maximum amount that can be transferred from the account is ₹4000 in 24 hours. And it has a small payment limit of ₹200-₹400 per transaction.

2. PRODUCT

UPI makes transfers of money between two bank accounts in real-time and works 24/7. Whereas UPI LITE is an on-device account. It sends money from the sender’s UPI LITE account to the receiver’s bank account.

3. REQUIREMENT OF PIN

UPI requires pins for every transaction. The pin should contain 4-6-digit code. On the contrary, the UPI LITE does not require any PIN for transactions and makes transactions easy.

4. TRANSACTION HISTORY

UPI records the transaction on the app in the payment history section as well as on the bank statement. You can view your transaction history on your bank passbook. On the other hand, UPI LITE records the transaction history only on the app. You won’t get the transaction history on your passbook.

5. AVAILABLITY

UPI applies to more than 100 bank accounts. It can send and receive money. Whereas UPI LITE applies to only 8 bank accounts. And can only send money.

HOW TO SET-UP UPI LITE-ON BHIM APP?

- Go to the Play Store or Apple Store on your device and install the BHIM app.

- Log in to your account.

- Link your bank account for transactions through UPI.

- Click on UPI LITE and select option ‘enable now’ option.

- Make a transfer to your device wallet from your bank account.

- Enter your UPI pin and transfer the amount.

- After the transfer is successful, your UPI LITE eWallet will be activated.

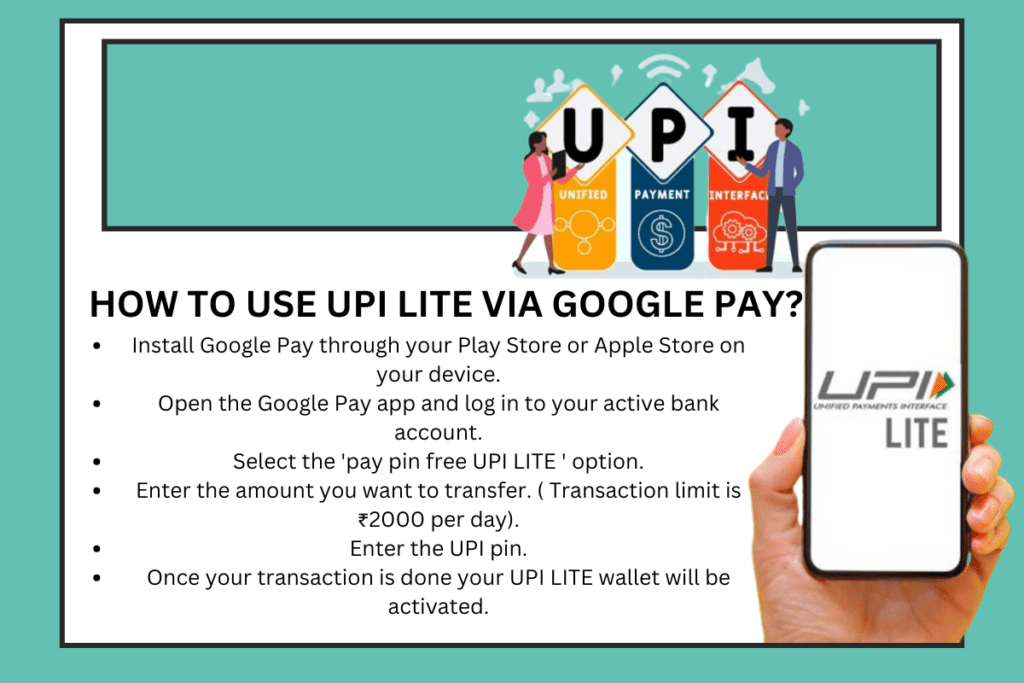

HOW TO USE UPI LITE VIA GOOGLE PAY?

- Install Google Pay through your Play Store or Apple Store on your device.

- Open the Google Pay app and log in to your active bank account.

- Select the ‘pay pin free UPI LITE ‘option.

- Enter the amount you want to transfer. (The transaction limit is ₹2000 per day.).

- Enter the UPI pin.

- Once your transaction is done, your UPI LITE wallet will be activated.

UPI LITE offers unlimited transactions for the user daily, but with small-value transactions only. It helps in the convenient transfer of funds. It also offers debit transaction users to transfer money offline without an interest connection. UPI LITE is safe in the case of cashless payments. It offers advanced security and device-binding features. UPI LITE is a very user-friendly option for day-to-day, easy transaction methods.