Related Post

Alternative investment is referred to as when the financial asset does not fall into any conventional investment categories. The conventional investment categories involve stocks, bonds, or cash.

Alternative investments include private equity, venture capital, real estate, commodities, collectables, hedge funds, cryptocurrencies, and more. These investments carry higher risk, longer horizons, and less liquidity than traditional options. They require specialized knowledge and involve diverse assets, markets, and strategies that reduce portfolio risk. Tactile assets like art and antiques, along with royalties, offer unique opportunities for diversification and potentially higher returns. Typically held by institutional investors or high-net-worth individuals, these investments come with high risk, a complex nature, and a lack of regulation.

What are the different alternative investments beyond stocks and real estate?

Let’s discuss some of the alternative investments that are beyond any stocks or real estate investment.Venture Capital

Venture capital or VC focuses mainly on early-stage funding or investment in a startup business that has high growth potential. The emerging companies provide their equity stakes in exchange for funding from venture capital investors. This type of investment can be risky as startup business sometimes faces failure but if they succeed the venture capital investors will get high returns. Therefore the investors of venture capital should have a high risk tolerance to face any difficulties that will come in the future.

Venture capital or VC focuses mainly on early-stage funding or investment in a startup business that has high growth potential. The emerging companies provide their equity stakes in exchange for funding from venture capital investors. This type of investment can be risky as startup business sometimes faces failure but if they succeed the venture capital investors will get high returns. Therefore the investors of venture capital should have a high risk tolerance to face any difficulties that will come in the future.

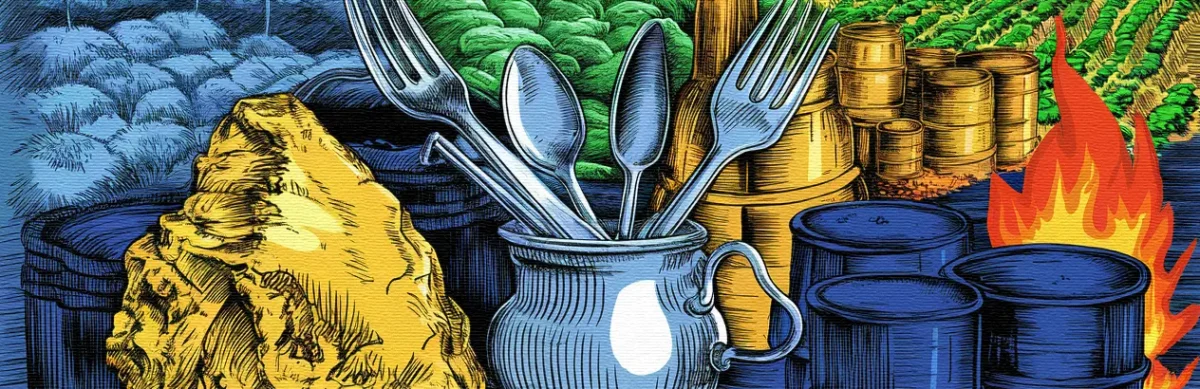

Commodities

Commodities include raw or physical materials such as gold, oil, natural gas, silver, or any agricultural products. Investors can easily invest in any substantial goods that have real-world uses. This investment can be done by direct ownership of the raw materials or holding future contracts. They have a lower correlation than any other traditional assets such as stocks and bonds which help in diversification. But they are highly volatile.

Commodities include raw or physical materials such as gold, oil, natural gas, silver, or any agricultural products. Investors can easily invest in any substantial goods that have real-world uses. This investment can be done by direct ownership of the raw materials or holding future contracts. They have a lower correlation than any other traditional assets such as stocks and bonds which help in diversification. But they are highly volatile.

Hegde Funds

Hedge funds are actively managed pooled investments in which the manager uses a wide range of strategies that may include buying borrowed money or any esoteric assets to generate a return average for their investors. They mainly aim to achieve positive returns from both the rising and failing markets.

Hedge funds are actively managed pooled investments in which the manager uses a wide range of strategies that may include buying borrowed money or any esoteric assets to generate a return average for their investors. They mainly aim to achieve positive returns from both the rising and failing markets.

Peer-To-Peer Lending

P2P is an online platform that connects individual borrowers to investors willing to lend money. They are mostly done on a private market and are often done with riskier clients. They offer higher returns but not always. The investor gets the benefit of earning interest on the loans they fund. Although the burrowers receive lower interest rates.

P2P is an online platform that connects individual borrowers to investors willing to lend money. They are mostly done on a private market and are often done with riskier clients. They offer higher returns but not always. The investor gets the benefit of earning interest on the loans they fund. Although the burrowers receive lower interest rates.

Collectables

The collectables involve assets such as art, antiques, rare coins, vintage wines, and many more. This investment is considered more appealing than any other investment as it offers aesthetic and historical value items. The collectable market is driven by conditions and the rarity of items. But the investment in these markets requires knowledge and proper information before making any investment.

The collectables involve assets such as art, antiques, rare coins, vintage wines, and many more. This investment is considered more appealing than any other investment as it offers aesthetic and historical value items. The collectable market is driven by conditions and the rarity of items. But the investment in these markets requires knowledge and proper information before making any investment.

Cryptocurrencies

Cryptocurrencies involve emerging digital currencies such as Bitcoin, Ethereum, and many other altcoins. They are viewed as alternative investments as they are far beyond the traditional investment markets like stocks and bonds.

Cryptocurrencies involve emerging digital currencies such as Bitcoin, Ethereum, and many other altcoins. They are viewed as alternative investments as they are far beyond the traditional investment markets like stocks and bonds.

Infrastructure Investment

The infrastructure investment includes the funding of projects that are related to many essential services like transportation, and communication networks. This investment may include the direct ownership of the infrastructure asset or even the public or private partnership with the infrastructure asset.

The infrastructure investment includes the funding of projects that are related to many essential services like transportation, and communication networks. This investment may include the direct ownership of the infrastructure asset or even the public or private partnership with the infrastructure asset.

Timberland and Farmland

The timberland includes investment in the forest for harvesting timber. And the farmland investment includes the agricultural lands. Both investments can provide higher returns by the sale of timber and crops. to invest in this area one needs to have proper knowledge and expertise in land management and agriculture.

Alternative investment has higher fees and minimum investment requirements than traditional investments. They also have lower transaction costs. Alternative investment can provide substantial benefits like diversification and higher returns. However, The investor should have proper knowledge and information before making any investment.

The timberland includes investment in the forest for harvesting timber. And the farmland investment includes the agricultural lands. Both investments can provide higher returns by the sale of timber and crops. to invest in this area one needs to have proper knowledge and expertise in land management and agriculture.

Alternative investment has higher fees and minimum investment requirements than traditional investments. They also have lower transaction costs. Alternative investment can provide substantial benefits like diversification and higher returns. However, The investor should have proper knowledge and information before making any investment.