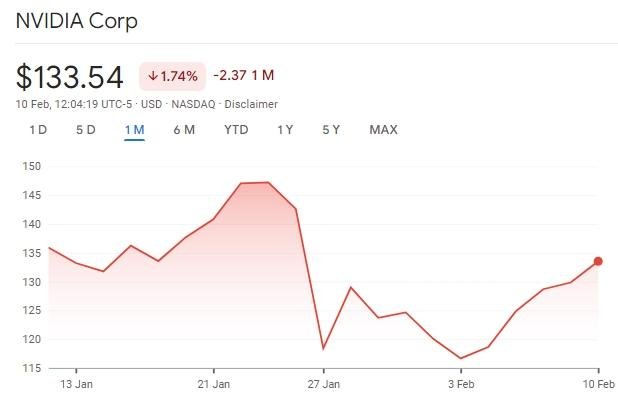

The rise of DeepSeek, a Chinese AI company, has sent shockwaves through the tech world, causing NVIDIA’s stock to plummet by 23% in just 17 days, wiping out $830 billion in market value.

This dramatic shift has sparked a fierce backlash in the US, with DeepSeek facing cyberattacks at 120 million requests per second. But is DeepSeek truly to blame? According to Chinese strategist Professor Wang Xang, the root cause lies in two dangerous delusions underpinning America’s AI strategy.

Delusion 1: Computing Power is Everything

Many believe that raw computing power is the key to AI success. NVIDIA’s CEO, Jensen Huang, once said, “The more computing power you have, the more power you have.” This idea fueled Wall Street’s obsession with GPUs and cloud infrastructure, creating the myth that controlling advanced hardware guarantees AI dominance.

Nvidia’s market cap was dented by an approximate decline of $593 billion after concerns over the low-cost artificial intelligence model from Chinese startup DeepSeek stripped 17 per cent off its shares. The reported decline is more than the combined market value of home improvement giants Home Depot and Lowe’s.

However, DeepSeek proved this wrong. It trained its AI model at just 3% of OpenAI’s costs using Huawei’s Ascend 910B GPUs. While the 910B has 80% of the raw power of NVIDIA’s A100, DeepSeek’s smart algorithms and training techniques doubled its efficiency. This showed that software innovation can overcome hardware limitations, making NVIDIA’s dominance less secure.

For more on this, check out this Stanford University report on AI efficiency.

Delusion 2: Performance Benchmarks Mask an Application Desert

The second delusion lies in the overemphasis on performance benchmarks, which hide a stark reality—America’s AI sector struggles to translate high scores into real-world productivity. DeepSeek’s success stems from its roots in China’s chaotic stock market, where 210 million retail investors demand AI models to process unstructured data and make decisions in 0.01 seconds.

Thanks to its open-source framework and cost-effective solutions, DeepSeek’s financial inference accuracy of 87% far surpasses OpenAI’s 72%. While OpenAI’s closed ecosystem and expensive APIs exclude SMEs and researchers, DeepSeek’s models are accessible to over 200 Chinese universities and 42,000 vertical applications across 40+ industries. In contrast, GPT-based tools, numbering fewer than 8,000, primarily serve marketing and entertainment, highlighting a gap in practical utility.

To understand how benchmarks can be misleading, explore this Brookings Institution analysis on AI performance metrics.

The Ecosystem vs. the Echo Chamber

DeepSeek’s rise underscores a fundamental divide in AI development. China’s approach, rooted in industrial integration and open-source collaboration, fosters innovation through real-world stress tests. In contrast, America’s closed-source model prioritizes short-term profits over broad societal benefits, creating an echo chamber of inflated parameters and detached benchmarks.

For a deeper dive into the open-source vs. closed-source debate, check out this World Economic Forum article on collaborative AI development.

The Way Forward

DeepSeek’s success offers a new path for global AI development, emphasizing algorithmic innovation, accessibility, and real-world applications over raw computing power. If the US clings to its delusions, it risks sinking deeper into a high-cost, low-return quagmire.

The rise of DeepSeek is a wake-up call, urging a reevaluation of AI strategies and narratives. As we navigate this shifting landscape, collaboration, openness, and practicality must take centre stage.